2025: The Privacy Reemergence

By

Chetanya Khandelwal, Kelvin Koh

Dec 17, 2025

Privacy has become one of the most unexpected themes of 2025. After years of limited attention—largely overshadowed by L1/L2/DA scaling narratives—a ~10x rally in Zcash’s price (ZEC) in the last 3 months, when the broader market struggled, forced investors to revisit privacy sector where substantial technical and product work had quietly been compounding. Zcash was the initial catalyst. Over the past few months, its wallet Zashi introduced NEAR-based cross-chain intents, a decentralized off-ramp, and private settlement flows— making shielded transfers usable at a consumer level. The upgrades triggered a sharp pickup in activity: large BTC→ZEC flows moved through Zashi, shielded supply increased from ~16% to nearly 30%, and both shielded transactions and shielded assets reached all-time highs. It was the first material improvement in Zcash’s onchain fundamentals in years.

The price rally then acted as an amplifier, but once attention shifted, it became clear that the broader privacy landscape had been evolving faster than most realized. The key question for 2026 is whether this marks a structural shift in how blockchains handle privacy, or simply another price-driven narrative cycle. To evaluate this, we examine why privacy matters now, how the technology and regulatory posture have evolved, and which new applications are beginning to emerge.

Two of crypto’s original cypherpunk objectives—permissionless digital money (Bitcoin as a globally accepted trillion-dollar asset) and permissionless programmable execution (ETH rollups, Solana, etc. can deliver millions of TPS)—are now solved at scale. The remaining missing pillar is “confidentiality”: the ability for users and institutions to control what information they disclose, rather than operating under transparency-by-default. Three developments explain why privacy has become essential now:

Institutions Are Moving Onchain. Stablecoins (> $9T in annual onchain settlement) now power Stripe, Shopify, PayPal, and tokenization pilots from BlackRock and others, reflecting the arrival of a new—and much larger—class of users in crypto. As institutions transact on public chains, they immediately encounter a structural problem: transparency exposes sensitive data that influence core commercial decisions. To operate and scale safely, institutions need stronger privacy guarantees. This is why JPMorgan, Citi, and other tokenization leaders cite privacy as a prerequisite for adoption, and why networks like Circle’s Arc and Canton incorporate privacy and auditability from day one.

Regulation Has Shifted From “Anti-Privacy” to “Compliant Privacy”. In 2025 the regulatory posture changed materially. The SEC launched Project Crypto; Congress advanced the GENIUS and CLARITY Acts; Treasury removed the Tornado Cash sanctions; and SEC Commissioner Peirce publicly affirmed that financial privacy is a legitimate requirement for digital payments. Regulators now distinguish between anonymity meant to evade oversight (unacceptable) and confidentiality with auditability, which aligns with traditional finance. This shift has validated new standards—view keys, selective-disclosure proofs, zkTLS, confidential ERC-20s—and enabled projects like Circle and Aleo to pilot compliant private stablecoins.

The Technology Is Now Viable for Early Use Cases. Privacy infrastructure only became practical in the past 18–24 months. ZK proving costs are down 100–200x since 2020; FHE throughput improved from ~1 TPS to 20–30 TPS; MPC/TEE systems now support institutional-grade key management and low-latency confidential execution. Tooling has matured so Rust/Solidity/Typescript compile directly into ZK circuits or encrypted programs. The technology is not ready for mass scale but is now fast and cheap enough for high-value early applications like payments — and can be embedded (e.g. Zama fhevm) directly into Ethereum rollups, Solana, and other blockchains without requiring separate L1s allowing compliant confidentiality without fragmenting liquidity or forcing developers to build new ecosystems from the ground up.

These shifts explain why privacy is becoming a requirement rather than an ideology. The next question is what this actually enables in practice — and where we’re already seeing early adoption.

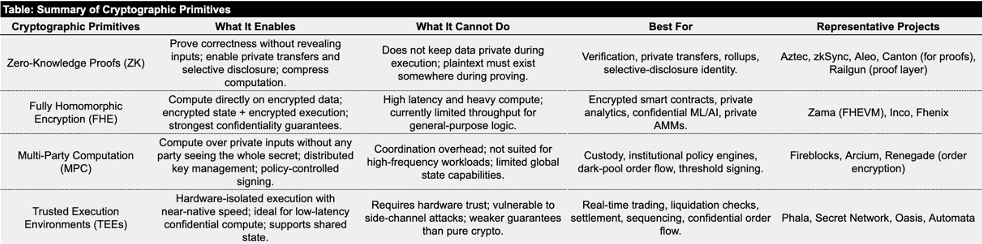

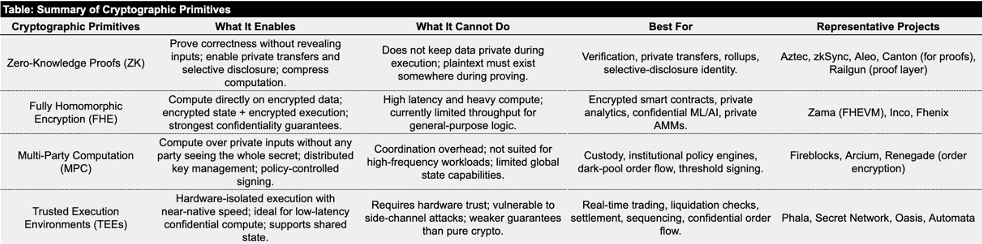

Advances in cryptography primitives like ZK, FHE, MPC, & TEEs have shifted privacy from simply hiding data (Tornado, Monero, etc.) to enabling encrypted computation with selective disclosure (Aztec, Aleo, Zama, etc.). This unlocks several categories of applications that could not exist on transparent blockchains.

Private Payments & Digital Cash: Stablecoins have clear mainstream PMF, but reaching Visa- or ACH-level usage requires unlocking broader consumer and corporate payment flows — which in turn requires privacy.

Aleo (ALEO) is purpose-built for private, compliant payments using a zkSNARK-based VM, the Leo language, and AleoBFT for efficient proof generation. In 2025, it partnered with Circle and Paxos to develop an audit-friendly, privacy-enabled USDC where balances stay encrypted but regulators can access view keys. Aleo has raised ~$300 million; mainnet launched in 2024 and currently trades at ~$230 million FDV.

Payy is a unique product offering privacy with a Venmo-like UI/UX. Users send dollars privately via simple links (iMessage, Telegram), while ZK proofs settle card-funded transactions without leaking metadata. It functions as a non-custodial, privacy-preserving Visa layer. Their app is live on both the Google and Apple app stores, and they recently launched a Visa card in the US.

Other Key projects: Zashi (ZCash), Plasma (XPL), Stripe’s Tempo, JPM’s Kinexys.

Private DeFi, Trading & Credit: Transparency is a core blocker for serious capital in DeFi—flows leak, MEV is unavoidable, and commercial strategies can’t be hidden. Modern privacy infrastructure solves this by enabling computation over shared but encrypted state.

Railgun enables private swaps, transfers, and lending through a shared encrypted state and ZK proofs, allowing multi-hop private interactions rather than isolated mixers. It processed ~$2 billion in private volume in 2025.

Renegade brings dark-pool execution onchain using MPC + ZK proofs to keep orders encrypted until settlement, preventing MEV and hiding trade intent. Dark pools represent ~15% of U.S. equity volume, highlighting the size of this opportunity.

Undercollateralized lending is one of DeFi’s largest missing markets. CeFi briefly scaled to ~$60B in 2022 before collapsing due to opaque, fraud-prone underwriting. Miden and Arcium are working to enable the first credible onchain alternative: borrowers share encrypted credit signals, and lenders verify eligibility utilizing cryptographic primitives.

Institutional workflows: settlement, collateral management, credit—require confidentiality, selective disclosure, and auditability, which modern privacy systems now provide.

Canton (CC) is an institutional focused Layer 1 provides selective-visibility settlement infrastructure where institutions see only the parts of a transaction relevant to them. ZK proofs ensure atomic correctness without global transparency. Canton is already used by BNY Mellon, Goldman, Deloitte, and others for tokenized treasuries, repo, collateral, and fund admin.

Aztec provides a programmable privacy rollup on Ethereum, enabling private payments, payroll, B2B settlement, and mixed public/private smart-contract logic. The project recently raised $61 million at a $490 million FDV (>$176 million total raised) and plans to launch mainnet in 2026 — making it one of the key privacy platforms to watch.

Other emerging systems like Cycles.money (multilateral debt clearing via ZK-TEE) and Zama's FHE (launching in 2026) are also pushing institutional workflows onchain.

Beyond Finance: Privacy primitives also support private decentralized identity (Humanity’s zkTLS), private AI inference (Nillion), encrypted social graphs, gaming, shared fraud-intelligence networks, etc. While early, these categories show how encrypted computation expands the design space well beyond finance.

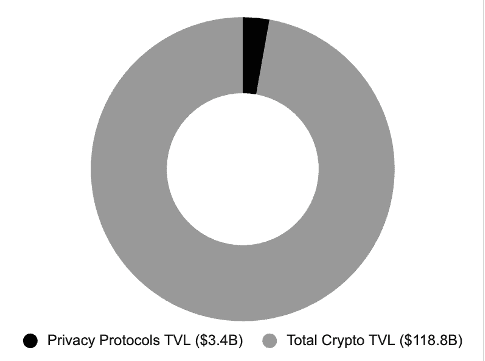

Despite meaningful progress, privacy adoption is still early. Privacy TVL—including Zcash’s shielded pools—accounts for only ~2.7% of total TVL; Railgun processes <1% of monthly DEX volume; Renegade, despite strong interest in dark-pool trading, has only ~$260 million in cumulative volume since its 2024 launch; Solana’s confidential token extensions has seen no user activity; and networks like Canton and Arc, while growing, remain small.

A key open question is whether people actually care enough about privacy to pay for it. Most users historically haven’t traded UX or speed for confidentiality, and it’s unclear whether privacy will be a standalone product or simply a feature embedded into bigger apps. Corporate demand is stronger, but most deployments are still in pilot mode. Regulation is improving, but not settled; a shift in political climate could slow things down. And the tech is still complex—ZK and FHE are hard to implement, TEEs rely on hardware trust, and combining multiple primitives increases risk.

That said, the current backdrop is the strongest the sector has seen. ZK and FHE cost curves continue to improve, developer tooling is maturing, private payment and settlement flows are working in production, institutional networks like Canton are live, and major platforms such as Arc, Aztec, and Zama are nearing launch. With privacy still representing a small share of crypto market cap (~5% of smart-contract platforms excluding BTC & ETH, and <1% excluding legacy assets like XMR and ZEC), the upside for category winners is significant if adoption accelerates—positioning privacy as one of the most closely watched themes for 2026.

Privacy protocols represent a small share of total crypto TVL

Source: DefiLlama

Privacy has become one of the most unexpected themes of 2025. After years of limited attention—largely overshadowed by L1/L2/DA scaling narratives—a ~10x rally in Zcash’s price (ZEC) in the last 3 months, when the broader market struggled, forced investors to revisit privacy sector where substantial technical and product work had quietly been compounding. Zcash was the initial catalyst. Over the past few months, its wallet Zashi introduced NEAR-based cross-chain intents, a decentralized off-ramp, and private settlement flows— making shielded transfers usable at a consumer level. The upgrades triggered a sharp pickup in activity: large BTC→ZEC flows moved through Zashi, shielded supply increased from ~16% to nearly 30%, and both shielded transactions and shielded assets reached all-time highs. It was the first material improvement in Zcash’s onchain fundamentals in years.

The price rally then acted as an amplifier, but once attention shifted, it became clear that the broader privacy landscape had been evolving faster than most realized. The key question for 2026 is whether this marks a structural shift in how blockchains handle privacy, or simply another price-driven narrative cycle. To evaluate this, we examine why privacy matters now, how the technology and regulatory posture have evolved, and which new applications are beginning to emerge.

Two of crypto’s original cypherpunk objectives—permissionless digital money (Bitcoin as a globally accepted trillion-dollar asset) and permissionless programmable execution (ETH rollups, Solana, etc. can deliver millions of TPS)—are now solved at scale. The remaining missing pillar is “confidentiality”: the ability for users and institutions to control what information they disclose, rather than operating under transparency-by-default. Three developments explain why privacy has become essential now:

Institutions Are Moving Onchain. Stablecoins (> $9T in annual onchain settlement) now power Stripe, Shopify, PayPal, and tokenization pilots from BlackRock and others, reflecting the arrival of a new—and much larger—class of users in crypto. As institutions transact on public chains, they immediately encounter a structural problem: transparency exposes sensitive data that influence core commercial decisions. To operate and scale safely, institutions need stronger privacy guarantees. This is why JPMorgan, Citi, and other tokenization leaders cite privacy as a prerequisite for adoption, and why networks like Circle’s Arc and Canton incorporate privacy and auditability from day one.

Regulation Has Shifted From “Anti-Privacy” to “Compliant Privacy”. In 2025 the regulatory posture changed materially. The SEC launched Project Crypto; Congress advanced the GENIUS and CLARITY Acts; Treasury removed the Tornado Cash sanctions; and SEC Commissioner Peirce publicly affirmed that financial privacy is a legitimate requirement for digital payments. Regulators now distinguish between anonymity meant to evade oversight (unacceptable) and confidentiality with auditability, which aligns with traditional finance. This shift has validated new standards—view keys, selective-disclosure proofs, zkTLS, confidential ERC-20s—and enabled projects like Circle and Aleo to pilot compliant private stablecoins.

The Technology Is Now Viable for Early Use Cases. Privacy infrastructure only became practical in the past 18–24 months. ZK proving costs are down 100–200x since 2020; FHE throughput improved from ~1 TPS to 20–30 TPS; MPC/TEE systems now support institutional-grade key management and low-latency confidential execution. Tooling has matured so Rust/Solidity/Typescript compile directly into ZK circuits or encrypted programs. The technology is not ready for mass scale but is now fast and cheap enough for high-value early applications like payments — and can be embedded (e.g. Zama fhevm) directly into Ethereum rollups, Solana, and other blockchains without requiring separate L1s allowing compliant confidentiality without fragmenting liquidity or forcing developers to build new ecosystems from the ground up.

These shifts explain why privacy is becoming a requirement rather than an ideology. The next question is what this actually enables in practice — and where we’re already seeing early adoption.

Advances in cryptography primitives like ZK, FHE, MPC, & TEEs have shifted privacy from simply hiding data (Tornado, Monero, etc.) to enabling encrypted computation with selective disclosure (Aztec, Aleo, Zama, etc.). This unlocks several categories of applications that could not exist on transparent blockchains.

Private Payments & Digital Cash: Stablecoins have clear mainstream PMF, but reaching Visa- or ACH-level usage requires unlocking broader consumer and corporate payment flows — which in turn requires privacy.

Aleo (ALEO) is purpose-built for private, compliant payments using a zkSNARK-based VM, the Leo language, and AleoBFT for efficient proof generation. In 2025, it partnered with Circle and Paxos to develop an audit-friendly, privacy-enabled USDC where balances stay encrypted but regulators can access view keys. Aleo has raised ~$300 million; mainnet launched in 2024 and currently trades at ~$230 million FDV.

Payy is a unique product offering privacy with a Venmo-like UI/UX. Users send dollars privately via simple links (iMessage, Telegram), while ZK proofs settle card-funded transactions without leaking metadata. It functions as a non-custodial, privacy-preserving Visa layer. Their app is live on both the Google and Apple app stores, and they recently launched a Visa card in the US.

Other Key projects: Zashi (ZCash), Plasma (XPL), Stripe’s Tempo, JPM’s Kinexys.

Private DeFi, Trading & Credit: Transparency is a core blocker for serious capital in DeFi—flows leak, MEV is unavoidable, and commercial strategies can’t be hidden. Modern privacy infrastructure solves this by enabling computation over shared but encrypted state.

Railgun enables private swaps, transfers, and lending through a shared encrypted state and ZK proofs, allowing multi-hop private interactions rather than isolated mixers. It processed ~$2 billion in private volume in 2025.

Renegade brings dark-pool execution onchain using MPC + ZK proofs to keep orders encrypted until settlement, preventing MEV and hiding trade intent. Dark pools represent ~15% of U.S. equity volume, highlighting the size of this opportunity.

Undercollateralized lending is one of DeFi’s largest missing markets. CeFi briefly scaled to ~$60B in 2022 before collapsing due to opaque, fraud-prone underwriting. Miden and Arcium are working to enable the first credible onchain alternative: borrowers share encrypted credit signals, and lenders verify eligibility utilizing cryptographic primitives.

Institutional workflows: settlement, collateral management, credit—require confidentiality, selective disclosure, and auditability, which modern privacy systems now provide.

Canton (CC) is an institutional focused Layer 1 provides selective-visibility settlement infrastructure where institutions see only the parts of a transaction relevant to them. ZK proofs ensure atomic correctness without global transparency. Canton is already used by BNY Mellon, Goldman, Deloitte, and others for tokenized treasuries, repo, collateral, and fund admin.

Aztec provides a programmable privacy rollup on Ethereum, enabling private payments, payroll, B2B settlement, and mixed public/private smart-contract logic. The project recently raised $61 million at a $490 million FDV (>$176 million total raised) and plans to launch mainnet in 2026 — making it one of the key privacy platforms to watch.

Other emerging systems like Cycles.money (multilateral debt clearing via ZK-TEE) and Zama's FHE (launching in 2026) are also pushing institutional workflows onchain.

Beyond Finance: Privacy primitives also support private decentralized identity (Humanity’s zkTLS), private AI inference (Nillion), encrypted social graphs, gaming, shared fraud-intelligence networks, etc. While early, these categories show how encrypted computation expands the design space well beyond finance.

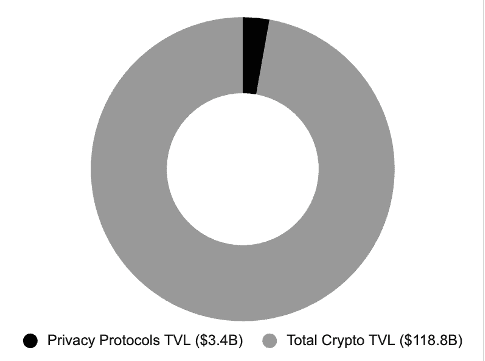

Despite meaningful progress, privacy adoption is still early. Privacy TVL—including Zcash’s shielded pools—accounts for only ~2.7% of total TVL; Railgun processes <1% of monthly DEX volume; Renegade, despite strong interest in dark-pool trading, has only ~$260 million in cumulative volume since its 2024 launch; Solana’s confidential token extensions has seen no user activity; and networks like Canton and Arc, while growing, remain small.

A key open question is whether people actually care enough about privacy to pay for it. Most users historically haven’t traded UX or speed for confidentiality, and it’s unclear whether privacy will be a standalone product or simply a feature embedded into bigger apps. Corporate demand is stronger, but most deployments are still in pilot mode. Regulation is improving, but not settled; a shift in political climate could slow things down. And the tech is still complex—ZK and FHE are hard to implement, TEEs rely on hardware trust, and combining multiple primitives increases risk.

That said, the current backdrop is the strongest the sector has seen. ZK and FHE cost curves continue to improve, developer tooling is maturing, private payment and settlement flows are working in production, institutional networks like Canton are live, and major platforms such as Arc, Aztec, and Zama are nearing launch. With privacy still representing a small share of crypto market cap (~5% of smart-contract platforms excluding BTC & ETH, and <1% excluding legacy assets like XMR and ZEC), the upside for category winners is significant if adoption accelerates—positioning privacy as one of the most closely watched themes for 2026.

Privacy protocols represent a small share of total crypto TVL

Source: DefiLlama

To learn more about investment opportunities with Spartan Capital, please contact ir@spartangroup.io