Prediction Markets as Emerging Financial Infrastructure

By

Chetanya Khandelwal, Kelvin Koh

Jan 19, 2026

Prediction markets are one of the earliest crypto-native applications, dating back to Ethereum’s inception. Augur, which ran Ethereum’s first ICO in August 2015 and raised over $5 million, pioneered decentralized prediction markets as a way to forecast real-world outcomes using open market principles. At its 2018 peak, Augur exceeded a $1 billion market cap before collapsing under high gas costs, slow resolution, thin liquidity, poor UX, and regulatory uncertainty. By 2023, it was effectively irrelevant, trading below $10 million.

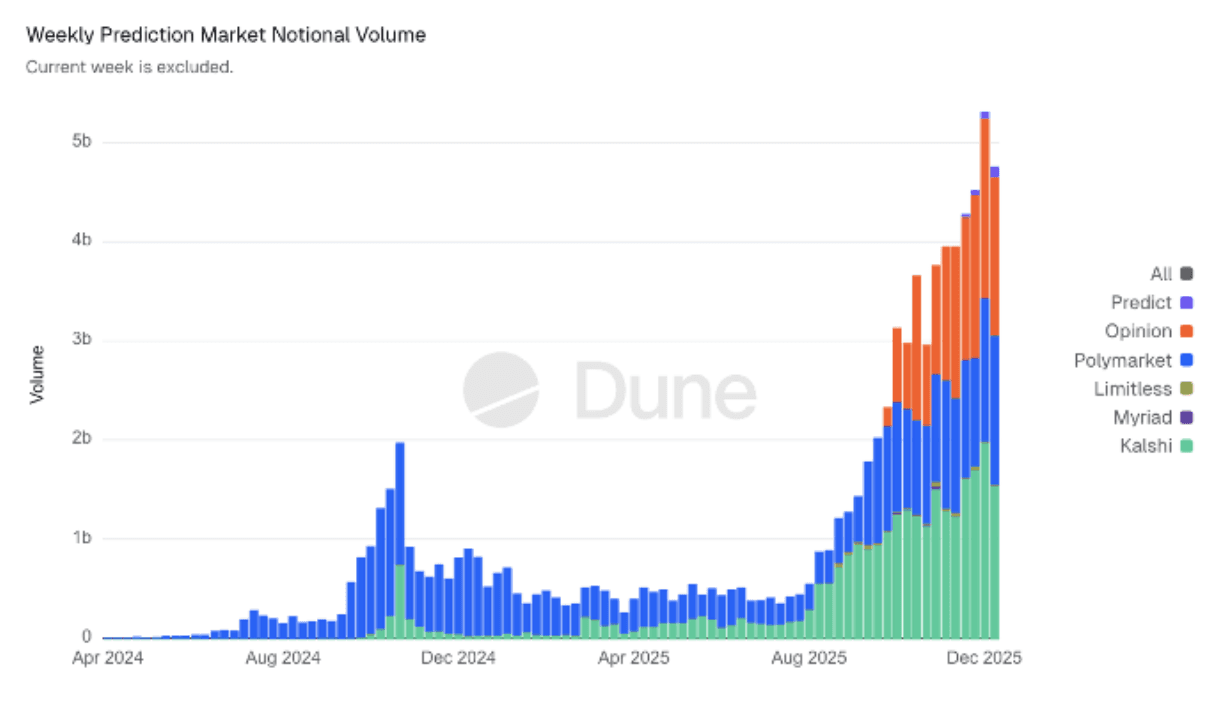

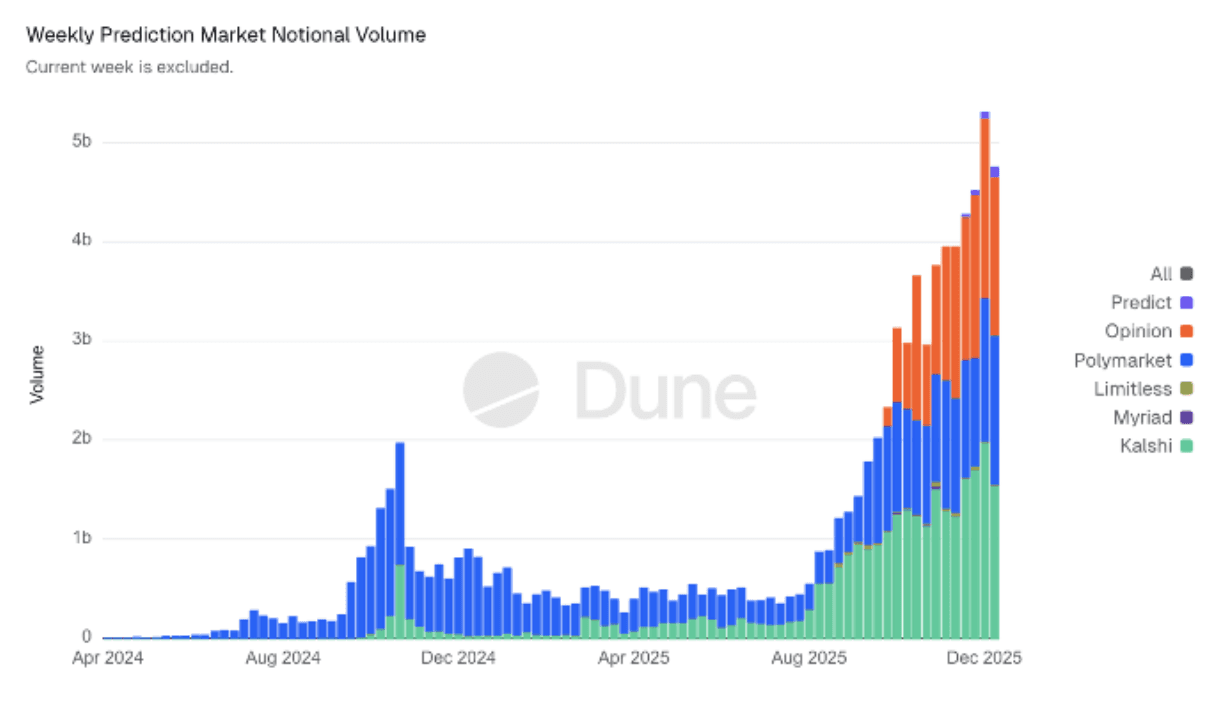

The idea was right; the timing and infrastructure were not. Polymarket rebuilt the model on faster, cheaper rails with stablecoin collateral, instant settlement, and simple interfaces. The 2024 U.S. election attracted liquidity and demonstrated what a high-functioning prediction market could look like at scale. But the real inflection came in 2025, when prediction markets expanded beyond election trading into a broader financial and information product. Weekly volumes surpassed $5 billion at peak, markets diversified into economics, technology, culture, and sports, and regulatory clarity began to emerge—most notably following Kalshi’s legal victory over the CFTC in May 2025.

Source: Dune Analytics

One of the key reasons why prediction markets took off in 2025 is regulatory legitimacy which helped to unlock distribution. CNN began displaying live Kalshi odds during coverage as a forecasting input rather than entertainment. Google Finance and Yahoo Finance started integrating prediction market probabilities alongside traditional financial data. Platforms including Robinhood, Coinbase, DraftKings, FanDuel, and ICE moved to add or partner on prediction products. Prediction markets are no longer framed as speculative betting venues, but as probabilistic signals increasingly embedded in media, finance, and decision-making systems.

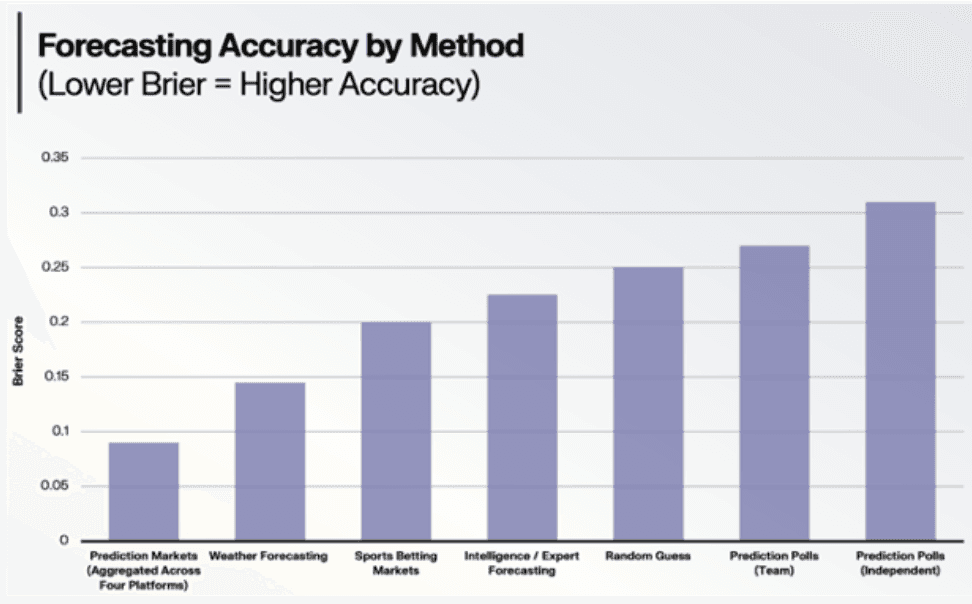

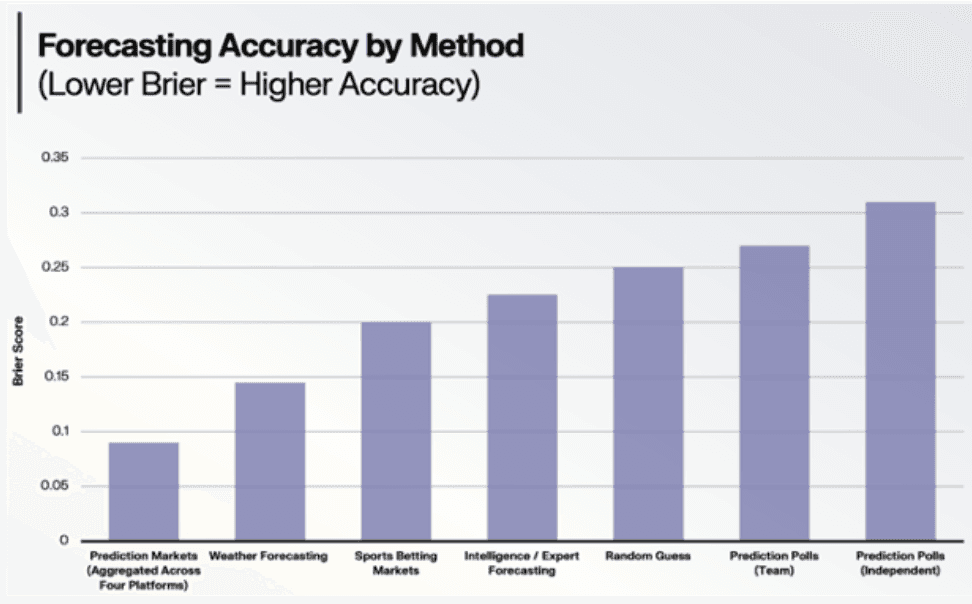

At their core, prediction markets are simple. A user buys a contract that pays $1 if an event occurs and $0 if it does not. The contract price reflects the market-implied probability. A $0.65 price implies a 65% likelihood. Participants who believe the probability is mispriced trade accordingly, earning profits if correct and losing capital if wrong. Despite their simplicity, prediction markets are among the most accurate forecasting systems available. Decades of academic research—from the Iowa Electronic Markets to modern platforms—show that they consistently outperform polls and expert forecasts. Measured by Brier scores, well-functioning prediction markets routinely score around ~0.09, beating traditional polling, expert consensus, and even many weather models.

Source: Keyrock, Brier.fyi

Prediction markets have moved beyond episodic speculation and are starting to resemble a durable financial product. Since early 2024, monthly notional volumes have grown from under $100 million to roughly $18 billion by December 2025, while monthly active users increased from ~4,000 to over 600,000. Liquidity depth, repeat participation, and market breadth have all improved, indicating that adoption is becoming structural rather than purely event-driven.

While early growth was dominated by political markets, 2025 marked a clear diversification. Economics and Technology & Science markets were the fastest-growing categories, expanding more than 9× and 16× year-on-year, respectively. Open interest growth followed the same pattern, led by economics and social-policy markets. This shift suggests users are increasingly expressing medium-term macro and policy views rather than placing isolated tail-risk bets.

Source: Source: Keyrock, Dune Analytics, Datadashboard

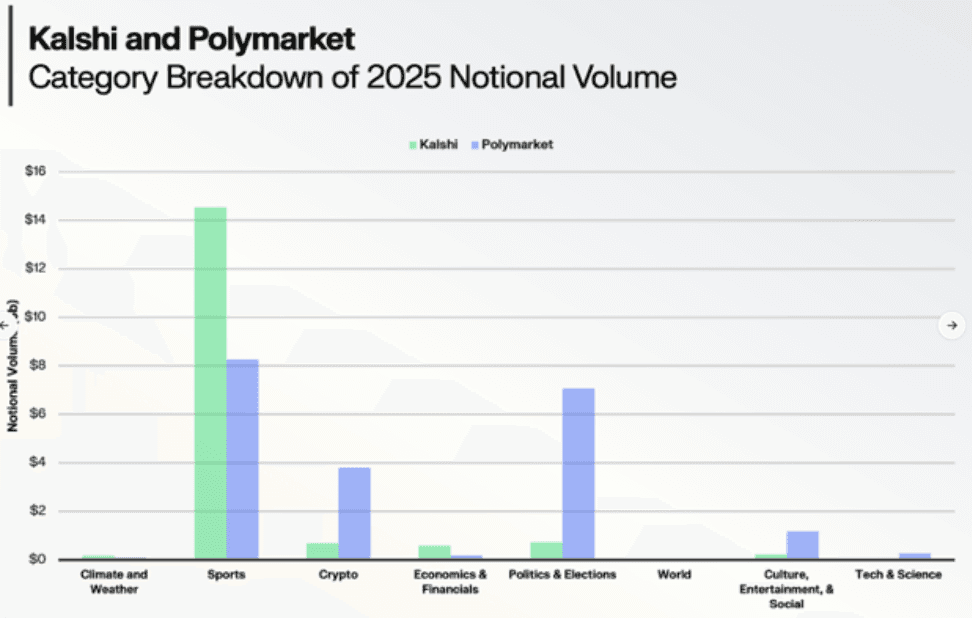

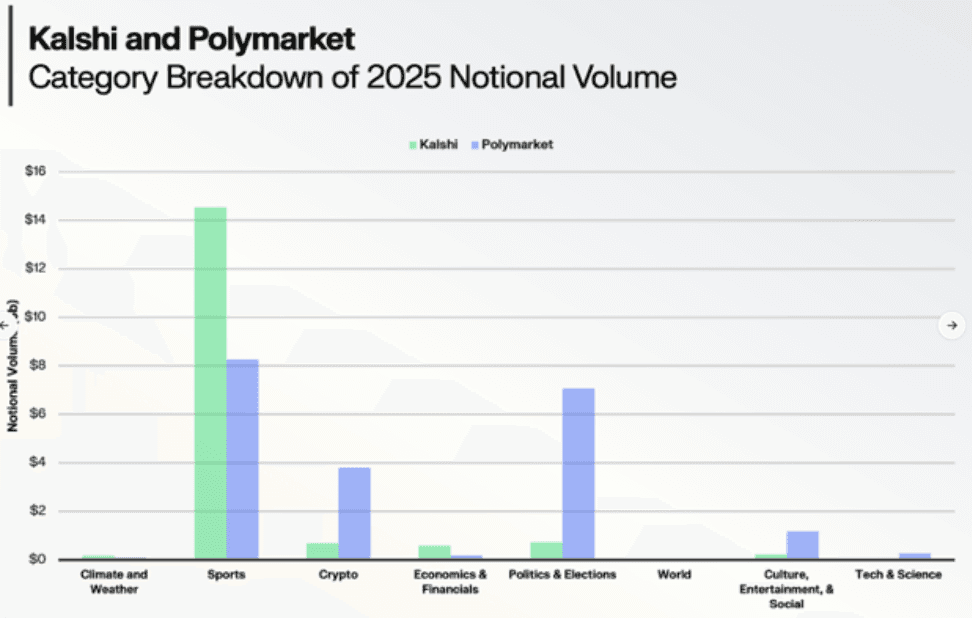

This evolution has been driven primarily by two platforms: Polymarket and Kalshi. Polymarket scaled first by leveraging decentralized, crypto-native infrastructure that bypassed regulatory friction. Built on Polygon and settled in USDC, it prioritized low fees, fast settlement, and global access. This allowed it to dominate early liquidity, processing roughly $14 billion in volume in 2024—largely driven by the U.S. election—and approximately $27 billion in 2025. Its volume is broadly distributed, with Sports, Crypto, and Politics each accounting for roughly 30-35% of activity. Kalshi followed the opposite path. As a CFTC-regulated Designated Contract Market, it grew more slowly initially (about $2 billion in volume in 2024) but benefited from regulatory clarity and access to traditional U.S. distribution. In 2025, integrations with brokers (SIG), fintech platforms (Robinhood), sports organizations (NHL), and major media (CNN)—accelerated adoption. Kalshi’s volume grew to approximately $23.8 billion (>10× YoY), though activity remains heavily concentrated in U.S. sports, which accounts for roughly 90% of volume, reflecting its access to the large domestic sports betting market.

The competitive landscape intensified in 2025 as both platforms expanded across regulation, distribution, and product. Polymarket acquired a CFTC-licensed exchange, allowing it to re-enter the U.S. while retaining access to non-U.S. users—giving it a structurally broader addressable market than Kalshi, which remains U.S.-only. At the same time, Kalshi moved towards crypto by adopting blockchain rails (Solana, BNB, Tron) and expanding crypto-related markets, reflecting the importance of serving crypto-native users. Competition is also playing out through partnerships and capital: Polymarket has secured integrations with X, Dow Jones, UFC, and ICE (NYSE), while Kalshi has partnered with CNN, Google Finance, Phantom, and others. This arms race is reflected in valuations, with Kalshi raising about $1.6 billion at a ~$11 billion valuation and Polymarket raising roughly $2.3 billion at a ~$9 billion valuation—both up more than 10× over the past year.

In prediction markets, the moat is primarily liquidity, credibility and distribution—a flywheel. Deeper liquidity improves price accuracy; better accuracy makes the data more useful; useful data earns distribution (media, brokers, dashboards); distribution brings more flow and market makers; which deepens liquidity again. Fees will compress as competition increases, but the winner is likely the venue whose probabilities become the default reference. Over time, accuracy itself becomes the product. Given the scale of the opportunity and the winner-take-most dynamics, competition is intensifying. New entrants continue to emerge, including crypto-native platforms such as Opinion (backed by Binance) and fintech giants such as Robinhood, Coinbase, FanDuel, and ICE-affiliated entities. The market is still early, but the takeaway is clear: prediction markets are no longer competing merely as betting venues, but as the canonical probability layer across finance, media, and enterprise decision-making.

U.S regulations remain the key uncertainty. At the federal level, momentum has shifted toward treating prediction markets as regulated financial instruments rather than gambling products, enabling national scaling under CFTC oversight. State-level challenges—particularly around sports markets—remain unresolved and could continue to create friction until federal preemption or legislative clarity emerges. Market integrity is another risk. Prediction markets trade information itself, making them vulnerable to insider trading and manipulation. Recent controversies, including suspicious trading around geopolitical events such as seizure of Venezuelan President, highlight the risk. As prediction market prices increasingly influence media narratives and financial decisions, trust becomes existential. Surveillance, position limits, and monitoring systems favor well-capitalized incumbents and raise barriers to entry.

Valuations also warrant caution. Both Polymarket and Kalshi saw roughly 10x valuation expansion between 2024 and late 2025, echoing prior crypto infrastructure cycles such as OpenSea’s $13.3 billion valuation during the NFT boom. While prediction markets have achieved deeper mainstream penetration than NFTs ever did, long-term outcomes depend on sustained adoption beyond headline events and deeper integration into everyday decision-making. Looking ahead, the setup for 2026 is strong but asymmetric. Regulation is improving, adoption metrics continue to rise, and probability data is increasingly embedded into institutional workflows. For liquid investors, direct exposure remains limited, with the most notable near-term catalyst being a potential Polymarket token launch—likely one of the largest crypto launches of 2026.

Prediction markets are one of the earliest crypto-native applications, dating back to Ethereum’s inception. Augur, which ran Ethereum’s first ICO in August 2015 and raised over $5 million, pioneered decentralized prediction markets as a way to forecast real-world outcomes using open market principles. At its 2018 peak, Augur exceeded a $1 billion market cap before collapsing under high gas costs, slow resolution, thin liquidity, poor UX, and regulatory uncertainty. By 2023, it was effectively irrelevant, trading below $10 million.

The idea was right; the timing and infrastructure were not. Polymarket rebuilt the model on faster, cheaper rails with stablecoin collateral, instant settlement, and simple interfaces. The 2024 U.S. election attracted liquidity and demonstrated what a high-functioning prediction market could look like at scale. But the real inflection came in 2025, when prediction markets expanded beyond election trading into a broader financial and information product. Weekly volumes surpassed $5 billion at peak, markets diversified into economics, technology, culture, and sports, and regulatory clarity began to emerge—most notably following Kalshi’s legal victory over the CFTC in May 2025.

Source: Dune Analytics

One of the key reasons why prediction markets took off in 2025 is regulatory legitimacy which helped to unlock distribution. CNN began displaying live Kalshi odds during coverage as a forecasting input rather than entertainment. Google Finance and Yahoo Finance started integrating prediction market probabilities alongside traditional financial data. Platforms including Robinhood, Coinbase, DraftKings, FanDuel, and ICE moved to add or partner on prediction products. Prediction markets are no longer framed as speculative betting venues, but as probabilistic signals increasingly embedded in media, finance, and decision-making systems.

At their core, prediction markets are simple. A user buys a contract that pays $1 if an event occurs and $0 if it does not. The contract price reflects the market-implied probability. A $0.65 price implies a 65% likelihood. Participants who believe the probability is mispriced trade accordingly, earning profits if correct and losing capital if wrong. Despite their simplicity, prediction markets are among the most accurate forecasting systems available. Decades of academic research—from the Iowa Electronic Markets to modern platforms—show that they consistently outperform polls and expert forecasts. Measured by Brier scores, well-functioning prediction markets routinely score around ~0.09, beating traditional polling, expert consensus, and even many weather models.

Source: Keyrock, Brier.fyi

Prediction markets have moved beyond episodic speculation and are starting to resemble a durable financial product. Since early 2024, monthly notional volumes have grown from under $100 million to roughly $18 billion by December 2025, while monthly active users increased from ~4,000 to over 600,000. Liquidity depth, repeat participation, and market breadth have all improved, indicating that adoption is becoming structural rather than purely event-driven.

While early growth was dominated by political markets, 2025 marked a clear diversification. Economics and Technology & Science markets were the fastest-growing categories, expanding more than 9× and 16× year-on-year, respectively. Open interest growth followed the same pattern, led by economics and social-policy markets. This shift suggests users are increasingly expressing medium-term macro and policy views rather than placing isolated tail-risk bets.

Source: Source: Keyrock, Dune Analytics, Datadashboard

This evolution has been driven primarily by two platforms: Polymarket and Kalshi. Polymarket scaled first by leveraging decentralized, crypto-native infrastructure that bypassed regulatory friction. Built on Polygon and settled in USDC, it prioritized low fees, fast settlement, and global access. This allowed it to dominate early liquidity, processing roughly $14 billion in volume in 2024—largely driven by the U.S. election—and approximately $27 billion in 2025. Its volume is broadly distributed, with Sports, Crypto, and Politics each accounting for roughly 30-35% of activity. Kalshi followed the opposite path. As a CFTC-regulated Designated Contract Market, it grew more slowly initially (about $2 billion in volume in 2024) but benefited from regulatory clarity and access to traditional U.S. distribution. In 2025, integrations with brokers (SIG), fintech platforms (Robinhood), sports organizations (NHL), and major media (CNN)—accelerated adoption. Kalshi’s volume grew to approximately $23.8 billion (>10× YoY), though activity remains heavily concentrated in U.S. sports, which accounts for roughly 90% of volume, reflecting its access to the large domestic sports betting market.

The competitive landscape intensified in 2025 as both platforms expanded across regulation, distribution, and product. Polymarket acquired a CFTC-licensed exchange, allowing it to re-enter the U.S. while retaining access to non-U.S. users—giving it a structurally broader addressable market than Kalshi, which remains U.S.-only. At the same time, Kalshi moved towards crypto by adopting blockchain rails (Solana, BNB, Tron) and expanding crypto-related markets, reflecting the importance of serving crypto-native users. Competition is also playing out through partnerships and capital: Polymarket has secured integrations with X, Dow Jones, UFC, and ICE (NYSE), while Kalshi has partnered with CNN, Google Finance, Phantom, and others. This arms race is reflected in valuations, with Kalshi raising about $1.6 billion at a ~$11 billion valuation and Polymarket raising roughly $2.3 billion at a ~$9 billion valuation—both up more than 10× over the past year.

In prediction markets, the moat is primarily liquidity, credibility and distribution—a flywheel. Deeper liquidity improves price accuracy; better accuracy makes the data more useful; useful data earns distribution (media, brokers, dashboards); distribution brings more flow and market makers; which deepens liquidity again. Fees will compress as competition increases, but the winner is likely the venue whose probabilities become the default reference. Over time, accuracy itself becomes the product. Given the scale of the opportunity and the winner-take-most dynamics, competition is intensifying. New entrants continue to emerge, including crypto-native platforms such as Opinion (backed by Binance) and fintech giants such as Robinhood, Coinbase, FanDuel, and ICE-affiliated entities. The market is still early, but the takeaway is clear: prediction markets are no longer competing merely as betting venues, but as the canonical probability layer across finance, media, and enterprise decision-making.

U.S regulations remain the key uncertainty. At the federal level, momentum has shifted toward treating prediction markets as regulated financial instruments rather than gambling products, enabling national scaling under CFTC oversight. State-level challenges—particularly around sports markets—remain unresolved and could continue to create friction until federal preemption or legislative clarity emerges. Market integrity is another risk. Prediction markets trade information itself, making them vulnerable to insider trading and manipulation. Recent controversies, including suspicious trading around geopolitical events such as seizure of Venezuelan President, highlight the risk. As prediction market prices increasingly influence media narratives and financial decisions, trust becomes existential. Surveillance, position limits, and monitoring systems favor well-capitalized incumbents and raise barriers to entry.

Valuations also warrant caution. Both Polymarket and Kalshi saw roughly 10x valuation expansion between 2024 and late 2025, echoing prior crypto infrastructure cycles such as OpenSea’s $13.3 billion valuation during the NFT boom. While prediction markets have achieved deeper mainstream penetration than NFTs ever did, long-term outcomes depend on sustained adoption beyond headline events and deeper integration into everyday decision-making. Looking ahead, the setup for 2026 is strong but asymmetric. Regulation is improving, adoption metrics continue to rise, and probability data is increasingly embedded into institutional workflows. For liquid investors, direct exposure remains limited, with the most notable near-term catalyst being a potential Polymarket token launch—likely one of the largest crypto launches of 2026.

To learn more about investment opportunities with Spartan Capital, please contact ir@spartangroup.io